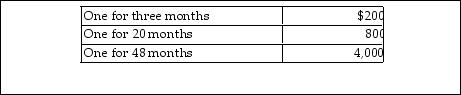

CT Computer Corporation, a cash- basis taxpayer, sells service contracts on the computers it sells. At the beginni January of this year, CT Corporation sold contracts with service to begin immediately:  The amount of income CT Corporation must report for this year is

The amount of income CT Corporation must report for this year is

Definitions:

Fixed Expenses

Costs that do not vary with the level of production or sales volume, such as rent or salaries.

Segmented Income Statement

An income statement broken down into segments or divisions of a company, allowing for analysis of profitability by segment.

Net Operating Income

The total profit of a business after deducting operating expenses but before subtracting any interest or taxes.

Common Fixed Expenses

Expenses that do not vary with production or sales levels, shared across different segments or departments of a company.

Q494: Self- employed individuals may claim, as a

Q568: Christa has made a $25,000 pledge to

Q794: If a capital asset held for one

Q845: Pat, an insurance executive, contributed $1,000,000 to

Q865: Wayne and Maria purchase a home on

Q1002: Steve and Jennifer are in the 32%

Q1724: Carl filed his tax return, properly claiming

Q1773: In which of the following situations are

Q2000: Ola owns a cottage at the beach.

Q2223: For non- cash charitable donations, an appraisal