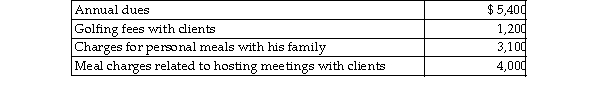

Joe is a self- employed tax attorney who frequently entertains his clients at his country club. Joe's club expenses i the following:  Assuming proper documentation is maintained, Joe may deduct

Assuming proper documentation is maintained, Joe may deduct

Definitions:

Fixed Manufacturing Overhead

Costs in manufacturing that do not vary with the level of production, such as rent, depreciation, and salaries.

Inventories

Assets held for sale in the ordinary course of business, in the process of production for such sale, or in the form of materials to be consumed in the production process.

Deferred

Refers to expenses or income that has been incurred but not yet recognized in the accounts, to be recognized in a future period.

Released

Refers to a product or information that has been made available to the public or to a specific group.

Q13: The ability to produce an endless number

Q45: During the current year, Ivan begins construction

Q106: If you subscribe to Paul Baltes's perspective

Q156: Which of the following is recommended by

Q161: Which of the following is TRUE of

Q486: For purposes of calculating depreciation, property converted

Q579: List those criteria necessary for an expenditure

Q1644: Mr. and Mrs. Thibodeaux (both age 35),

Q1793: If a medical expense reimbursement is received

Q2101: Expenses incurred in connection with conducting a