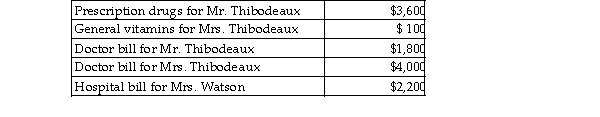

Mr. and Mrs. Thibodeaux (both age 35) , who are filing a joint return, have adjusted gross income of $100,000 in 2018. During the tax year, they paid the following medical expenses for themselves and for Mrs. Thibodeaux's mother, Mrs. Watson (age 63) . Mrs. Watson provided over one- half of her own support.  Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Mr. and Mrs. Thibodeaux received no reimbursement for the above expenditures. What is the amount of their deductible itemized medical expenses?

Definitions:

Maximum Rent

The highest price that can be charged for a property or piece of land, often regulated by law in rent-controlled areas to protect tenants from excessive rent increases.

Price Elastic

refers to the responsiveness of the quantity demanded of a good or service to a change in its price.

Per-Unit Tax

A tax imposed on a product based on the number of units purchased, not the value of the purchase.

Buyers

Individuals or entities that exchange money for goods and services.

Q57: Two-year-old Julia is learning to talk, and

Q73: Dr. Berenstein holds the view that behavior

Q153: List and briefly describe Urie Bronfenbrenner's five

Q183: According to the APA guidelines, after the

Q638: Which of the following items will result

Q834: Ovi is a sales representative for a

Q884: One of the requirements which must be

Q1324: A taxpayer's home in California is destroyed

Q2059: Diane, a successful accountant with an annual

Q2136: During the current year, Lucy, who has