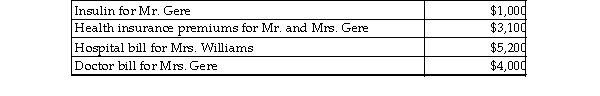

Mr. and Mrs. Gere, who are filing a joint return, have adjusted gross income of $50,000 in 2018. During the tax ye they paid the following medical expenses for themselves and for Mrs. Gere's mother, Mrs. Williams. The Gere's c claim Mrs. Williams as their dependent, but she has too much gross income.  Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of t deductible itemized medical expenses?

Mr. and Mrs. Gere (both age 40) received no reimbursement for the above expenditures. What is the amount of t deductible itemized medical expenses?

Definitions:

Semantics

The study of meaning in language, including the analysis of the meanings of words, phrases, and sentences.

Encoding

The process of converting ideas into a form that can be communicated, such as transforming thoughts into language or gestures.

Impression Management

The process by which individuals attempt to control the impressions others form of them, often in professional or social contexts.

Intimidation

The act of frightening or overawing someone, especially in order to make them do what one wants.

Q68: Which of the following statements regarding qualified

Q131: While ethological theory stresses _ factors, ecological

Q153: List and briefly describe Urie Bronfenbrenner's five

Q209: Flevy is conducting an extensive market study

Q232: Tobey receives 1,000 shares of YouDog! stock

Q286: Ted pays $2,100 interest on his automobile

Q430: All recognized gains and losses must eventually

Q639: Which statement is correct regarding SIMPLE retirement

Q1131: Dana paid $13,000 of investment interest expense

Q1446: Richard, a self- employed business consultant, traveled