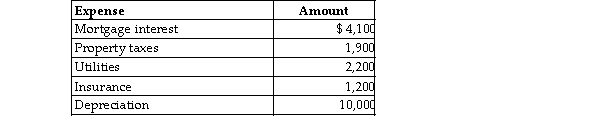

Abby owns a condominium in the Great Smokey Mountains. During the year, Abby uses the condo a total of 21 days. The condo is also rented to tourists for a total of 79 days and generates rental income of $12,500. Abby incurs the following expenses:  Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the property will be

Using the IRS method of allocating expenses, the amount of depreciation that Abby may take with respect to the property will be

Definitions:

Price Taker

An entity (often a company or individual) that has no control to dictate prices for goods or services in the market and must accept the prevailing market price.

Maximum Profit

The highest possible financial gain that a business can achieve from its operations over a specific period.

Natural Monopolies

Situations where a single firm can supply a good or service to an entire market at a lower cost than could multiple firms.

ATC

Average Total Cost, which is the sum of all production costs divided by the quantity of output produced, incorporating both fixed and variable costs.

Q475: Avantra Inc. is a professional firm with

Q566: Rebecca is the beneficiary of a $500,000

Q650: Caleb's 2018 medical expenses before reimbursement for

Q783: In the current year, Marcus reports the

Q1126: Greg is the owner and beneficiary of

Q1280: For a cash- basis taxpayer, security deposits

Q1381: Kelly was sent by her employer to

Q1592: Rocky owns The Palms Apartments. During the

Q1644: Mr. and Mrs. Thibodeaux (both age 35),

Q1684: If the principal reason for a taxpayer's