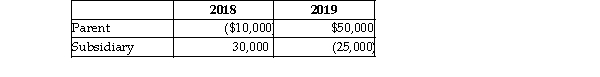

Parent and Subsidiary Corporations form an affiliated group. In 2018, the initial year of operation, P and Subsidiary filed separate returns. In 2019, the group files a consolidated tax return. The results and 2019 are: Taxable Income  How much of Subsidiary's loss can be carried back to last year?

How much of Subsidiary's loss can be carried back to last year?

Definitions:

Donor IVF

The transfer of a donor’s ovum, fertilized in a laboratory dish, to the uterus of another woman.

Artificial Insemination

A medical procedure that involves the direct insertion of sperm into a woman's cervix, fallopian tubes, or uterus to facilitate pregnancy.

Uterus

A major female reproductive organ in which fetal development occurs.

Selective Abortion

The practice of terminating a pregnancy based upon selective criteria such as genetic anomalies, sex of the fetus, or the presence of specific traits.

Q2: Which of the following events is an

Q12: What is a stock redemption? What are

Q14: Lawrence Corporation reports the following results during

Q31: Blair and Cannon Corporations are the two

Q35: Mary and Martha, who had been friends

Q85: What is the IRS's position regarding whether

Q107: Boxer Corporation buys equipment in January of

Q1021: On May 18, of last year, Carter

Q1198: Under what circumstances might a taxpayer elect

Q1560: Emily made the following interest free loans