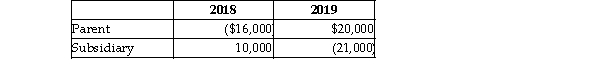

Parent and Subsidiary Corporations form an affiliated group. In 2018, the initial year of operation, Parent and Subsidiary filed separate returns. In 2019, the group files a consolidated return. Taxable Income  How much of the Subsidiary loss can be carried back to last year?

How much of the Subsidiary loss can be carried back to last year?

Definitions:

Mechanistic Processes

Systems or methods that operate or are explained through mechanical or predictable outcomes, often relating to the fundamental physical or biochemical operations underlying a phenomenon.

S-R Association

The connection between a stimulus (S) and the response (R) it triggers, fundamental to behaviorist theories of learning.

Behavior-Reinforcement Belief

The conviction that the likelihood of a behavior occurring can be increased by following it with a positive consequence or reward.

Q3: New York Corporation adopts a plan of

Q13: The acquiring corporation does not recognize gain

Q45: Dragon Corporation reports a distribution on its

Q61: Subsidiary Corporation purchases a used machine from

Q66: Van owns all 1,000 shares of Valley

Q81: Tia owns 2,000 shares of Bass Corporation

Q85: What is the IRS's position regarding whether

Q86: Cardinal and Bluebird Corporations both use a

Q96: Identify which of the following statements is

Q1666: Sec. 179 tax benefits are recaptured if