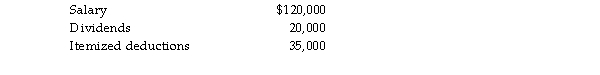

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:  In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whet

In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whet

$40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classi as a gift. What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Definitions:

Fungal Spores

Reproductive units produced by fungi, capable of developing into new fungal organisms under suitable environmental conditions, important for fungal distribution and diversity.

Selfishness

Behavior in which an individual puts its own interests above those of others, often at the expense of group welfare.

Behavioral Syndromes

Consistent patterns of behavior across different situations, often seen in animals, including humans, indicating a possible genetic or environmental basis.

Fitness

An organism's ability to survive and reproduce, thereby contributing its genes to the next generation.

Q25: In the current year, Donna gives $50,000

Q43: A foreign corporation is a CFC that

Q48: Identify which of the following statements is

Q48: Identify which of the following statements is

Q58: Identify which of the following statements is

Q66: Four years ago, Roper transferred to his

Q80: The sale of a partnership interest always

Q82: Krause Corporation makes an S election, believing

Q95: Prior to 2018, domestic corporation X owns

Q103: Identify which of the following increases Earnings