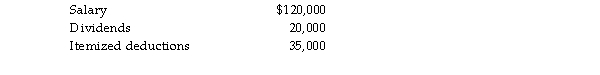

Latka Novatny gave you the following information to use in the preparation of his current year's tax return:  In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whet

In addition, he received $40,000 from a relative for whom he had worked previously. You have researched whet

$40,000 should be classified as a gift or compensation and are confident that substantial authority exists for classi as a gift. What tax compliance issues should you consider in deciding whether to report or exclude the $40,000?

Definitions:

Control Group

In experimental research, a group of subjects that does not receive the experimental treatment or intervention, serving as a baseline to compare effects.

Memory Task

An activity designed to assess or improve the capacity to recall or recognize information.

Experimental Group

In research, the group of participants that receives the treatment or condition being tested, contrasted with the control group that does not.

Random Assignment

A technique for assigning human participants or animal subjects to different groups in an experiment using randomization, which ensures that each participant or subject has an equal chance of being placed in any group.

Q1: Five years ago, George and Jerry (his

Q8: A new partner, Gary, contributes cash and

Q18: Which of the following credits is available

Q42: Nathan is single and owns a 54%

Q45: Why are stock dividends generally nontaxable? Under

Q63: A trust reports the following results: <img

Q78: What is the benefit of the 65-

Q87: The exemption amount for an estate is<br>A)

Q113: Which of the following items indicate that

Q188: A controlled foreign corporation (CFC) is incorporated