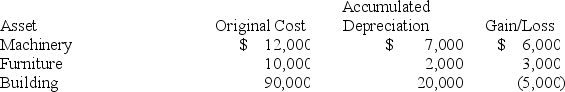

Andrew,an individual,began business four years ago and has never sold a §1231 asset.Andrew owned each of the assets for several years.In the current year,Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Discount Sources

Various means or strategies by which buyers can obtain goods or services at reduced prices, such as coupons, clearance sales, or promotional codes.

Cost Function

A mathematical formula that calculates the total cost incurred by a company to produce a specific quantity of a product or service.

Used-Car Dealer

A business or individual that specializes in selling pre-owned vehicles to consumers.

Colluding Firms

Companies that engage in an agreement, often secretly, to limit competition and increase prices for mutual benefit.

Q18: Employees who are at least 50 years

Q21: Georgeanne has been employed by SEC Corp.for

Q22: Sole proprietorships must use the same tax

Q51: Mason paid $4,100 of interest on a

Q57: How is the recovery period of an

Q73: Which of the following statements regarding the

Q76: Qualified distributions from traditional IRAs are nontaxable

Q89: Racine started a new business in the

Q94: Kristine sold two assets on March 20th

Q100: Which of the following statements concerning tax