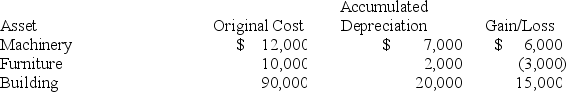

Suzanne,an individual,began business four years ago and has never sold a §1231 asset.Suzanne owned each of the assets for several years.In the current year,Suzanne sold the following business assets:

Assuming Suzanne's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Assuming Suzanne's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Definitions:

Profit

The financial gain achieved when the revenue gained from a business activity exceeds the expenses, costs, and taxes associated with sustaining the activity.

Tenancy In Common

Joint ownership of property in which each party owns an undivided interest that passes to his or her heirs at death.

Heirs

Individuals legally entitled to receive a portion of a deceased person's estate.

Fee Simple

a type of estate in land, which provides the owner with the most complete form of ownership, including the right to use, lease, or sell the property.

Q4: Taxpayers may use historical data to determine

Q12: Ethan (single)purchased his home on July 1,2009.He

Q13: P corporation owns 60 percent of the

Q22: Suzanne received 20 ISOs (each option gives

Q33: Annika's employer provides each employee with up

Q80: Rodger owns 100 percent of the shares

Q80: Suzanne,an individual,began business four years ago and

Q92: Gessner LLC patented a process it developed

Q105: Arlington LLC exchanged land used in its

Q107: Bull Run sold a computer for $1,200