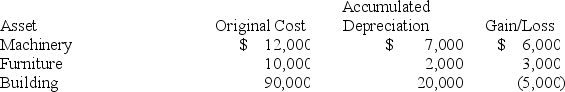

Andrew,an individual,began business four years ago and has never sold a §1231 asset.Andrew owned each of the assets for several years.In the current year,Andrew sold the following business assets:

Assuming Andrew's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Assuming Andrew's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Andrew's tax liability?

Definitions:

Fortunes

Large amounts of money or very valuable assets, often acquired or accumulated over time.

Poverty Line

A threshold set by governments or organizations to define the minimum income necessary to cover basic living costs, below which individuals are considered to be living in poverty.

Income Quintile

A statistical measure that divides a population into five equal groups according to their income levels, used to analyze income distribution.

Highest Quintile

Refers to the top 20% of the population sorted by income or wealth, indicating those with the highest levels of each.

Q19: Heidi retired from GE (her employer)at age

Q25: If a C corporation incurs a net

Q47: Long-term capital gains are taxed at the

Q50: Akiko and Hitachi (married filing jointly for

Q55: The deduction for qualified business income applies

Q62: All capital gains are taxed at preferential

Q69: Which taxpayer would not be considered a

Q76: Even a cash-method taxpayer must consistently use

Q91: Without an election,the income from an employee's

Q95: Janey purchased machinery on April 8<sup>th</sup> of