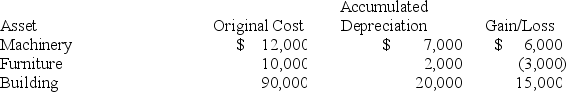

Suzanne,an individual,began business four years ago and has never sold a §1231 asset.Suzanne owned each of the assets for several years.In the current year,Suzanne sold the following business assets:

Assuming Suzanne's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Assuming Suzanne's marginal ordinary income tax rate is 32 percent,what is the character of the gains and losses and what affect do they have on Suzanne's tax liability?

Definitions:

Disruptive Behavior

Actions that interrupt or hinder the normal flow of activities in a specific context, often seen in educational or workplace settings.

Record Form

A standardized template or document used to collect and organize data systematically.

Behavior Rating Scale System

A method used to assess and document an individual's behaviors, attitudes, or skills, typically through observer ratings, often used in educational and clinical settings.

Student Rating Scales

Tools or instruments used to evaluate or assess students' performance, behavior, or attitudes, typically completed by teachers or peers.

Q3: During 2019,Montoya (age 15)received $2,200 from a

Q22: In certain circumstances,a taxpayer who does not

Q24: The amount of interest income a taxpayer

Q28: In order to deduct a portion of

Q28: Which of the following best describes distributions

Q39: For alternative minimum tax purposes,taxpayers are required

Q77: Unincorporated entities with only one individual owner

Q78: If an employer withholds taxes from an

Q98: A business generally adopts a fiscal or

Q123: Which of the following is not true