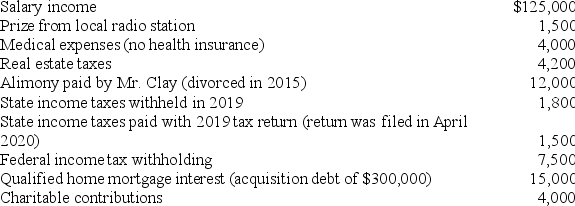

During all of 2019,Mr.and Mrs.Clay lived with their four children (all are under the age of 17).They provided over one-half of the support for each child.Mr.and Mrs.Clay file jointly for 2019.Neither is blind,and both are under age 65.They reported the following tax-related information for the year.(Use the tax rate schedules)

1.What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)

1.What are the Clays' taxes payable or refund due? (Ignore the alternative minimum tax.)

2.What are the Clays' tentative minimum tax and alternative minimum tax?

Definitions:

Validate the Data

The process of ensuring that data collected is accurate, reliable, and represents what it purports to measure.

Document the Sound

The process of recording or transcribing specific sounds, often for the purpose of analysis or diagnosis in medical or environmental studies.

Novice Nurses

Nursing professionals in the early stages of their career who are acquiring new skills and knowledge in the field.

Skills and Experience

Skills and experience refer to the abilities and knowledge gained through practice, training, or previous professional roles, crucial for performing tasks effectively.

Q7: The tax rate schedules are set up

Q11: Employees are not allowed to deduct FICA

Q27: Andres has received the following benefits this

Q30: What happens if the taxpayer owes an

Q33: A parcel of land is always a

Q48: Unrecaptured §1250 gain is taxed at a

Q59: In 2019,Brittany,who is single,cares for her father,Raymond.Brittany

Q68: Which of the following statements regarding the

Q93: All investment expenses are itemized deductions.

Q93: Which of the following is a true