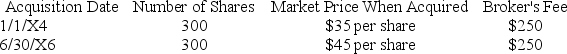

On December 1,20X7,George Jimenez needed a little extra cash for the upcoming holiday season,and sold 250 shares of Microsoft stock for $50 per share less a broker's fee of $200 for the entire sale transaction.Prior to the sale,George held the following blocks of Microsoft stock (associated broker's fee paid at the time of purchase).(Do not round intermediate calculations.)

If his goal is to minimize his current capital gain,how much capital gain will George report from the sale?

If his goal is to minimize his current capital gain,how much capital gain will George report from the sale?

Definitions:

Communication Barriers

Obstacles that hinder the effective exchange of information between individuals or groups.

Filtering

The act of selectively passing substances through a barrier, or metaphorically, the process of selectively presenting or withholding information.

Head Fry Cook

The lead role in a kitchen responsible for frying foods, overseeing the fry station, and managing related staff.

Upward Communication

Messages sent from the lower levels of the organizational hierarchy to the higher levels.

Q7: Assume that Joe (single)has a marginal tax

Q9: Katlyn reported $300 of net income from

Q21: Adjusted taxable income is defined as follows

Q25: Assume Georgianne underpaid her estimated tax liability

Q56: Alton reported net income from his sole

Q74: Rachel is an engineer who practices as

Q82: Brandon,an individual,began business four years ago and

Q89: Larry recorded the following donations this year:

Q89: Brandy sold a rental house that she

Q143: Which of the following statements regarding FICA