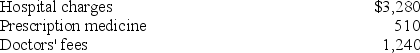

Erika (age 62)was hospitalized with injuries from an auto accident this year.She incurred the following expenses from the accident:

In addition,Erika's auto was completely destroyed in the accident.She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident.What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

In addition,Erika's auto was completely destroyed in the accident.She bought the car several years ago for $18,000 and it was worth $4,700 at the time of the accident.What are Erika's itemized deductions this year if she was uninsured and her AGI is $40,000?

Definitions:

Long-Term Negative Feelings

Persistent negative emotions, such as sadness, anger, or frustration, that last over an extended period.

Chronic Positive Affect

A persistent state of positive emotional experience and mood over an extended period of time.

Theory Of Planned Behavior

Theory to explain how intentions predict behaviors.

Social Norms

Implicit or explicit rules that govern the behavior of members within a society, indicating what is considered acceptable or unacceptable.

Q25: What are the rules limiting the amount

Q54: On December 1,20X7,George Jimenez needed a little

Q54: The American opportunity credit is available only

Q57: One primary difference between corporate and U.S.Treasury

Q89: Which of the following has the lowest

Q93: Acme published a story about Paul,and as

Q111: Madison's gross tax liability is $9,000.Madison had

Q117: Aubrey and Justin file married filing separately.This

Q119: It is generally more advantageous from a

Q123: Jasmine and her husband,Arty,have been married for