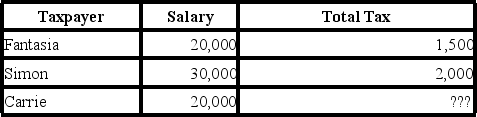

Given the following tax structure,what amount of tax would need to be assessed on Carrie to make the tax horizontally equitable? What is the minimum tax that Simon should pay to make the tax structure vertically equitable based on Fantasia's tax rate? This would result in what type of tax rate structure?

Definitions:

Real GDP

The measure of the value of all final goods and services produced within a country adjusted for inflation or deflation.

DSO

Stands for Days Sales Outstanding, a measure used by companies to assess the average number of days it takes to collect payment after a sale has been made.

Bad Debt

Money owed to a company that is unlikely to be paid by the debtor, often considered a loss for the company.

Credit Policy

The guidelines a company follows to determine credit terms for customers, including payment terms, credit limits, and how to handle late payments.

Q5: When do children begin to build their

Q14: A complete set of genetic information for

Q14: The inspiratory and expiratory centers are located

Q14: In April of Year 1,Martin left his

Q16: Antonella works for a company that pays

Q17: The adrenal cortex consists of _ tissue;

Q23: Consider the following tax rate structures.Is it

Q27: What is the purpose of the enzymes

Q32: Jennifer and Stephan are married at year-end

Q95: The constructive receipt doctrine is a natural