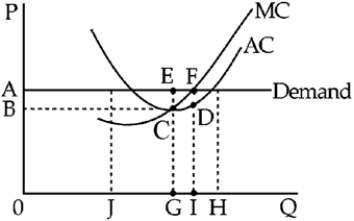

Figure 10-3

-A perfectly competitive firm should continue to expand output until

Definitions:

Risk-Free Rate

The return on an investment with zero risk, typically associated with government bonds.

Market Risk Premium

The Market Risk Premium is the additional return an investor expects from holding a risky market portfolio instead of risk-free assets.

Beta

Beta measures the volatility of an investment relative to the market as a whole, indicating how much an investment's price is likely to move in relation to market changes.

Risk-Free Rate

The Risk-Free Rate is the theoretical rate of return on an investment with zero risk, typically represented by the yield on government securities like U.S. Treasury bills.

Q28: The U.S.Postal Service engages in price discrimination.

Q37: One disadvantage of corporations is the double

Q61: In the long run the prices charged

Q70: The airline dominating Charlotte, North Carolina, once

Q90: In the long run, more costs become

Q135: Since the Red Cross supplies 95 percent

Q136: According to the excess capacity theorem, if

Q184: Game theory is based on the idea

Q198: In Figure 11-9, which of the following

Q198: Game theory may be used to solve