THESE FACTS ARE USED FOR THE NEXT QUESTION.

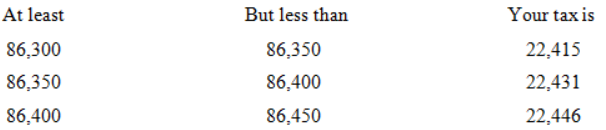

Mr. Harley Davidson earned $107,300 adjusted gross income) in 1992. After application of the relevant legal provisions, his taxable income was $86,362. The relevant portion of the tax table reads:

If taxable income is:

-Approximately what average effective tax rate did Mr. Davidson pay?

Definitions:

Unused Capacity

The portion of a company's production potential that is not being utilized to manufacture goods or provide services.

Estimated Activity

An approximation of the amount of work or level of effort needed for a particular task or project.

Activity at Capacity

The level of operational activity that a company can achieve using its current resources without incurring additional costs.

Machine-Hours

A measure of the amount of time machines are used in the production process, often related to the allocation of manufacturing overhead.

Q5: A request for proposal (RFP) should include

Q5: In a regressive tax rate structure:<br>A) the

Q10: When mixing two signals, the highest sum

Q13: In the Williamson "target zone" plan, the

Q16: All 5 GHz bands are available to

Q19: A general rule is that, as international

Q19: Which of the following is the best

Q23: In the United States, freedom of expression<br>A)

Q26: The derivation of the aggregate demand curve

Q33: By 1870 fire alarm boxes were in