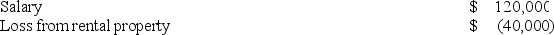

Judy, a single individual, reports the following items of income and loss:

Judy owns 100 percent of the rental property and actively participates in the rental of the property. Calculate Judy's AGI.

Judy owns 100 percent of the rental property and actively participates in the rental of the property. Calculate Judy's AGI.

Definitions:

Adjusting Entries

Journal entries made at the end of an accounting period to update account balances before the preparation of financial statements.

Unbilled Consulting Revenue

Unbilled consulting revenue refers to earnings from consulting services that have been delivered but not yet invoiced to the client.

Depreciation

The process of methodically dividing the expense of a physical asset over its estimated useful life.

Prepaid Services

Expenses paid in advance for services which will be received in the future.

Q8: For AGI deductions are commonly referred to

Q17: To be considered a qualifying child of

Q24: Describe one of the elements of poetry.

Q54: Samantha was ill for four months this

Q58: John Maylor is a self-employed plumber of

Q61: This year Darcy made the following charitable

Q62: This year, Benjamin Hassell paid $20,000 of

Q65: Demeter is a single taxpayer. Her AGI

Q89: Deb has found it very difficult to

Q114: Tax avoidance is a legal activity that