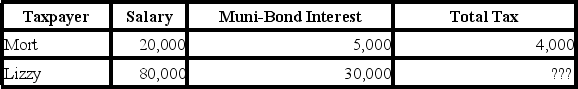

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Masked Branding

A marketing strategy where a brand deliberately conceals its direct association with a product or service to appeal to a different consumer segment or to test new markets.

Discernible Brand

A brand that is easily recognized and distinguished from others in the market due to unique characteristics or qualities.

Penetration-Pricing

A pricing strategy where a product is initially set at a low price to attract customers and gain market share, eventually raising prices once this objective is achieved.

Incidental Learning

Learning that occurs unintentionally and without explicit attempts to learn.

Q12: Margaret recently received a parking ticket. This

Q18: Boxer LLC has acquired various types of

Q19: Which of the following would NOT be

Q34: Santa Fe purchased the rights to extract

Q36: Laurie is an independent thinker and enjoys

Q41: Why are performance appraisals useful? What are

Q49: Jonah, a single taxpayer, earns $150,000 in

Q63: Doug runs a lawn care company. He

Q91: All taxpayers may use the §179 immediate

Q102: The 200 percent or double declining balance