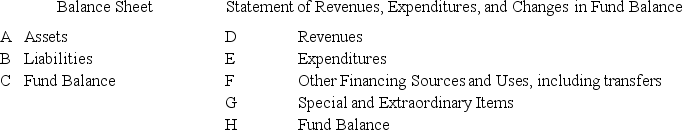

Listed below are the sections of the Balance Sheet and Statement of Revenues, Expenditures, and Changes in Fund Balance that would be prepared for the General Fund:

Certain accounts from the general ledger or other transactions of the City of Six Mile are listed below. For each account or transaction identify the section of the appropriate financial statement where each account would be reported. If an account is not reported on either statement, indicate that by using a X. A section may be used more than once.

Certain accounts from the general ledger or other transactions of the City of Six Mile are listed below. For each account or transaction identify the section of the appropriate financial statement where each account would be reported. If an account is not reported on either statement, indicate that by using a X. A section may be used more than once.

1.Services rendered to the City by employees

2. Allowance for Uncollectible Taxes

3. Advance to Enterprise Fund

4. Sale of park land (considered unusual in nature but under the control of management)

5. Property taxes levied and collected

6. Fund Balance – Nonspendable – Inventory

7. Vouchers Payable

8. Transfer to the Special Revenue Fund

9. Correction of Prior Year Error

10. Due to Internal Service Fund

11. Purchase of a capital asset

12. Building inspection services provided to contractors

13. Receipt of materials ordered

14. Payment from Fund A to Fund B for transaction erroneously recorded in Fund B

15. Insurance recovery from a tornado (tornado was considered unusual and infrequent)

16. Investments

17. Interest earned on investments

18. Short-term borrowing from a bank

19. Interest paid on short-term loan

20. Due from Special Revenue Fund

Definitions:

Long-term Investments

Assets that a company intends to hold for more than one year, typically including stocks, bonds, or real estate, aimed at generating long-term income or appreciation.

Intangible Assets

Non-physical assets of value to a company, such as patents, trademarks, goodwill, and copyrights.

Normal Account Balance

The typical or expected balance of an account, where asset and expense accounts are usually debit balances and liability, equity, and revenue accounts are credit balances.

Revenue Account

An account that tracks the income a company generates from its business activities.

Q3: The General Fund transferred $10,000 to Enterprise

Q4: Identify and describe the four purposes of

Q5: Listed below are the sections of the

Q11: Debt Service Fund expenditures would include all

Q12: Classroom teachers should the primary individuals responsible

Q15: For girls, early sexual maturity is a

Q15: A Private-Purpose Trust Fund has investments totaling

Q19: <span class="ql-formula" data-value="\begin{array}{llr} \text { Charges

Q40: Construction in Progress would be recorded as

Q47: Which of the following could never be