A company makes 2 products A and B from 2 resources. The products have the following resource requirements and produce the accompanying profits. The available quantity of resources is also shown in the table.

Management has developed the following set of goals

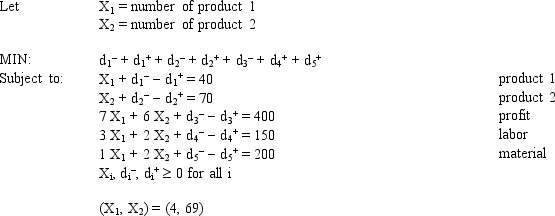

Goal 1: Produce approximately 40 urits of product 1

Goal 2: Produce approxinately 70 urits of product 2

Goal 3: Achieve a profit aver $400.

Goal 4: Consume less than 150 hours of labor

Goal 5:Consume lesse than 200 \text ounces of material

Based on the following GP formulation of the problem, and the associated optimal solution, what formulas should go in cells D6:F6, B9:F9, and B16 of the following Excel spreadsheet? NOTE: Formulas are not required in all of these cells.

Definitions:

Warranty Expenses

Costs associated with the obligation to repair, replace, or remediate goods that have not met the selling criteria or customer expectations.

Pretax Financial Income

Income calculated before taxes are applied, representing a company's earnings based solely on its operations and other financial activities.

Income Taxes Payable

The amount of income taxes that a company has accrued but has not yet paid to the tax authority.

Depreciation Expense

The allocation of the cost of a tangible asset over its useful life.

Q6: Refer to Exhibit 11.1. What Excel function

Q16: Refer to Exhibit 11.12. What is the

Q36: Using the information in Exhibit 12.2, what

Q37: Consider the constraint X<sub>3</sub> + X<sub>4</sub>

Q38: Refer to Exhibit 11.5. What formula should

Q39: A constraint which represents a target value

Q40: Models which are setup in an intuitively

Q50: If using the regression tool for two-group

Q63: An oil company wants to create

Q66: The number of constraints in network flow