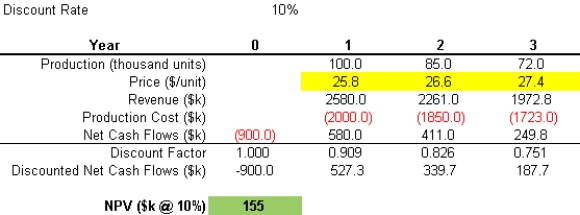

A firm is considering investing $0.9M in a typical industrial manufacturing application with a three-year production planning cycle under a forecasted market price environment. A simple three-period project pro forma cash flow sheet for this project is shown below:  In the pro forma, the production and price forecast in each period translate to revenue, which can then be netted of production costs to arrive at the expected cash flow in each period. The cash flows are then discounted at a rate that is commensurate with the riskiness of the project (here, assumed to be 10%).

In the pro forma, the production and price forecast in each period translate to revenue, which can then be netted of production costs to arrive at the expected cash flow in each period. The cash flows are then discounted at a rate that is commensurate with the riskiness of the project (here, assumed to be 10%).

-The Net Present Value (NPV) is the sum of the discounted cash flows. What is the NPV of the project, including the required investment?

Definitions:

Footnote Disclosure

Additional notes included in financial statements to provide more detailed information about the company's fiscal status, accounting policies, or individual line items.

Contingencies

Conditions or events with uncertain outcomes that may represent potential liabilities and are recorded in financial statements if they are probable and estimable.

Sick Pay Policy

A company's formal plan detailing the compensation employees receive when they are unable to work due to illness.

Vacation Pay

This refers to the compensation employees are entitled to receive for days they are on vacation and not working.

Q3: (A) Find an optimal solution to the

Q8: The control limits for an R chart

Q13: The two basic types of control charts

Q13: (A) Write out algebraic expressions for all

Q49: If the span of a moving average

Q68: Residuals separated by one period that are

Q79: If the coefficient of correlation r =

Q79: The term autocorrelation refers to the observation

Q80: Suppose that a simple exponential smoothing model

Q80: (A) Assume that the weight of each