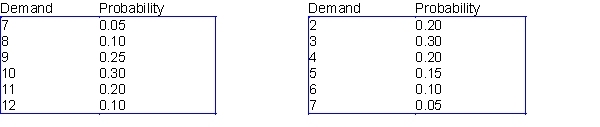

Oregon State University has reached the final four in the 2016 NCAA Women's Basketball Tournament, and as a result, a sweatshirt supplier in Corvallis is trying to decide how many sweatshirts to print for the upcoming championships. The final four teams (Oregon State, University of Washington, Syracuse, and University of Connecticut) have emerged from the quarterfinal round, and there is a week left until the semifinals, which are then followed in a couple of days by the finals. Each sweatshirt costs $12 to produce and sells for $24. However, in three weeks, any leftover sweatshirts will be put on sale for half price, $12. The supplier assumes that the demand (in thousands) for his sweatshirts during the next three weeks, when interest is at its highest, follows the probability distribution shown in the table below. The residual demand, after the sweatshirts have been put on sale, also has the probability distribution shown in the table below. The supplier realizes that every sweatshirt sold, even at the sale price, yields a profit. However, he also realizes that any sweatshirts produced but not sold must be thrown away, resulting in a $12 loss per sweatshirt.

Demand distribution at regular price Demand distribution at reduced price

-Use @RISK simulation add-in to analyze the sweatshirt sales. Do this for normal distributions, where we assume that the regular demand is normally distributed with mean 10,000 and standard deviation 1500, and that the demand at the reduced price is normally distributed with mean 5,000 and standard deviation 1500.

Definitions:

Intrinsic Value

The fundamental value of a company, stock, currency, or product determined through financial analysis without reference to its market value.

March Put

An options contract giving the holder the right to sell an asset at a specified price before or on a March expiration date.

Underlying Stock

The basic security or asset upon which derivative contracts, such as options and futures, are based.

Exercise Price

The predetermined price at which an option can be exercised, allowing the holder to buy or sell the underlying asset.

Q4: An oil company controls two oil fields.

Q9: Priti is wondering whether time of day

Q11: Mook Corp. has utilized three different types

Q15: A probability distribution is bounded if there

Q15: Consider importing the following text string with

Q32: Every linear programming problem involves optimizing a:<br>A)

Q64: (A) Formulate a linear programming model that

Q76: The following scatterplot compares the selling price

Q80: (A) Assume that the weight of each

Q97: The seasonal component of a time series