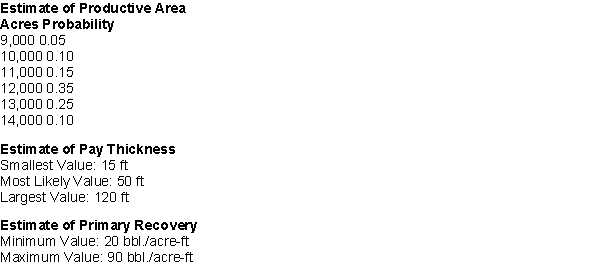

An oil company is trying to determine the amount of oil that it can expect to recover from an oil field. The unknowns are: the area of the field (in acres), the thickness of the oil-sand layer, and the primary recovery factor (in barrels per acre per foot of thickness). Based on geological information, the following probability distributions have been estimated  The amount of reserves that can be produced is then the product of the area, thickness, and recovery factor:

The amount of reserves that can be produced is then the product of the area, thickness, and recovery factor:

Number of barrels = Productive Area x Pay Thickness x Primary Recovery Factor

-(A) Use @RISK distributions to generate the three random variables and derive a distribution for the amount of reserves. What is the amount we can expect to recover from this field?

(B) The production output is a product of three very different types of input distributions. What does the output distribution look like? What are the implications of the shape of this distribution?

(C) What is the standard deviation of the recoverable reserves? What are the 5th and 95th percentiles of this distribution? What does this imply about the uncertainty in estimating the amount of recoverable reserves?

(D) Suppose you think oil price is normally distributed with a mean of $65 per barrel and a standard deviation of $10. How much revenue do you expect the field to produce (ignore discounting)?

(E) Finally, your engineer is uncertain about costs to drill wells to develop the field, but she thinks the most likely cost will be $1.7Bn, although it could be as much as $3Bn or as little as $1Bn. What is your expected profit from the field?

(F) What is the chance that you will loose money? Is this a risky venture?

Definitions:

Duress

Unlawful pressure brought to bear on a person, causing the person to perform an act that he or she would not otherwise perform (or refrain from doing something that he or she would otherwise do).

Entire Transaction

The complete process or series of associated dealings, typically concerning a business or financial agreement.

Undue Influence

An act of unfairly persuading someone to make a decision that benefits another at their expense.

Confidential Relationship

A bond between parties that necessitates the trust to not disclose classified or private information.

Q3: Using the 'Text Import Wizard' or the

Q5: Megan is currently working in a text

Q16: Coding males as 1 and females as

Q18: The moving average method is perhaps the

Q40: The scatterplot is a graphical technique used

Q41: We typically choose between a symmetric and

Q54: What if the GM satisfaction rate is

Q71: Workforce scheduling problems are often integer programming

Q79: A time series is any variable that

Q85: Financial analysts may attempt to determine which