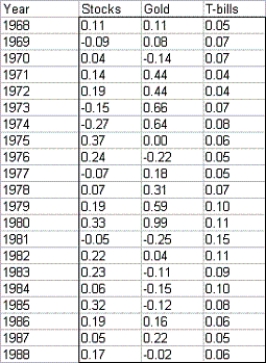

Your parents are discussing their retirement portfolio with you so that you can be informed not only about their holdings, but learn how to manage your own. The risk index of an investment can be obtained by taking the absolute values of percentage changes in the value of the investment for each year and averaging them. Suppose your dad asks you to determine what percentage of his money he should have invested in T-bills, gold, and stocks in the 1980s and 1990s based on data he provides for the years 1968-1988. The table below lists the annual returns (percentage changes in value) for these investments during these years.  Let the risk index of a portfolio be the weighted average of the risk indexes of these investments, where the weights are the fractions of your parents' money assigned to the investments. Suppose that the amount of each investment must be between 20% and 50% of the total invested. You would like the risk index of your portfolio to equal 0.15, and your goal is to maximize the expected return on your portfolio. Determine the maximum expected return on their portfolio, subject to the stated constraints. Use the average return earned by each investment during the years 1968-1988 as their estimate of expected return.

Let the risk index of a portfolio be the weighted average of the risk indexes of these investments, where the weights are the fractions of your parents' money assigned to the investments. Suppose that the amount of each investment must be between 20% and 50% of the total invested. You would like the risk index of your portfolio to equal 0.15, and your goal is to maximize the expected return on your portfolio. Determine the maximum expected return on their portfolio, subject to the stated constraints. Use the average return earned by each investment during the years 1968-1988 as their estimate of expected return.

Definitions:

Break-even Point

The point where total costs and total revenues are the same, leading to neither profit nor loss in sales or production levels.

Sales Dollars

The overall income earned from the sales of products or services, measured in currency.

Break-even

The point at which total costs and total revenue are equal, resulting in no profit or loss for the business.

Variable Cost

Outgoings that are directly influenced by how much is produced or sold, including the costs of labor and materials.

Q7: (A) Summarize the findings of the stepwise

Q12: In a network representation of a transportation

Q14: Which of the following is not one

Q16: In multiple regressions, if the F-ratio is

Q25: Which of the following statements is/are true

Q26: What happens to the revenue when the

Q37: In a nonlinear transformation of data, the

Q50: (A) Use the information above to estimate

Q53: In a marketing and sales model, what

Q54: Correlogram is a bar chart of autocorrelation