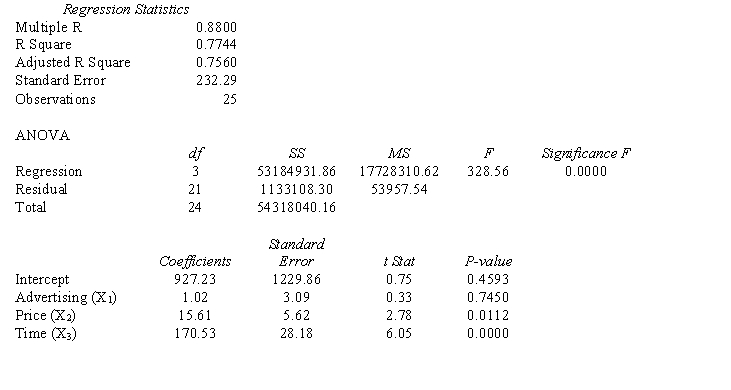

A regression analysis relating a company's sales, their advertising expenditure, price, and time resulted in the following.

a.At 95% confidence, determine whether or not the regression model is significant. Fully explain how you arrived at your conclusion (give numerical reasoning) and what your answer indicates.

b.At 95% confidence determine which variables are significant and which are not. Explain how you arrived at your conclusion (Give numerical reasoning).

c.Fully explain the meaning of R-square, which is given in this model. Be very specific and give numerical explanation.

Definitions:

Horizontal Analysis

A financial analysis technique that compares historical financial data over a series of reporting periods to identify trends and growth patterns.

Comparative Income Statements

Financial statements that present the revenues, expenses, and net income of a company over multiple periods for comparison.

Debt Management Ratios

Those ratios—debt to total assets, debt to stockholders’ equity, and times interest earned—which measure a company’s mix of debt and equity financing.

Equity Financing

The process of raising capital through the sale of shares in a company, leading to share ownership by investors.

Q3: Two faculty members (X and Y)

Q9: Which of the following is not present

Q17: Refer to Exhibit 19-6. The null hypothesis

Q19: The Laspeyres index is a weighted aggregate

Q27: Refer to Exhibit 22-2. An approximate 95%

Q30: Refer to Exhibit 21-2. The expected value

Q36: The sales volumes of CMM, Inc., a

Q59: A multiple regression analysis between yearly

Q60: Refer to Exhibit 12-5. The p-value is<br>A)between

Q106: A regression model in which more than