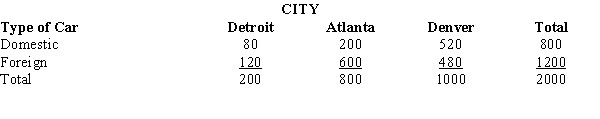

A group of 2000 individuals from 3 different cities were asked whether they owned a foreign or a domestic car. The following contingency table shows the results of the survey.  At = 0.05 using the p-value approach, test to determine if the type of car purchased is independent of the city in which the purchasers live.

At = 0.05 using the p-value approach, test to determine if the type of car purchased is independent of the city in which the purchasers live.

Definitions:

Capital Gains

The profit from the sale of assets such as stocks, bonds, or real estate, which exceeds the original purchase price.

Preferential Tax Treatment

Financial policies or regulations that reduce tax rates or alter tax policies in favor of certain businesses, industries, or transactions.

Capital Investments

Expenditures by a business to acquire or upgrade physical assets such as property, industrial buildings, or equipment.

Mortgage Exemption

A provision in tax law or regulation that allows certain mortgage payments, interest, or property taxes to be excluded from taxable income.

Q15: In order to test for the significance

Q18: A random sample of 87 airline pilots

Q41: A term used to describe the case

Q46: Refer to Exhibit 16-2. The test statistic

Q52: A regression analysis relating a company's sales,

Q53: Refer to Exhibit 9-5. At 95% confidence,

Q58: The z value for a 97.8% confidence

Q73: Refer to Exhibit 10-8. The null hypothesis<br>A)should

Q102: In the past, the average age

Q105: You are given an ANOVA table below