R

Definitions:

Sole Proprietorship

A business structure where a single individual owns, operates, and is responsible for the business, enjoying all profits and bearing all losses.

Limited Liability Corporation

A business structure that combines the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation.

Non-Profit Organization

is an entity that operates for a collective, public, or social benefit rather than generating profits for owners or investors.

Professional Corporation

A type of corporate structure available to professionals like lawyers, doctors, and accountants, which offers certain legal and financial protections.

Q25: Hypothetical reasoning is typically used to produce:<br>A)

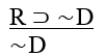

Q26: Use an ordinary proof (not conditional or

Q37: If Andy and Carol pass the test,

Q87: In a sample of 400 students in

Q117: Given the following sorites: All N are

Q124: For Syllogism 1I, the major premise is:<br>A)

Q192: Given the following syllogism: <br><img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6612/.jpg" alt="Given

Q243: The truth table for Statement 3G has

Q289: For Syllogistic Form 3I, after filling in

Q312: ∼Q ∨ S <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6612/.jpg" alt="∼Q ∨