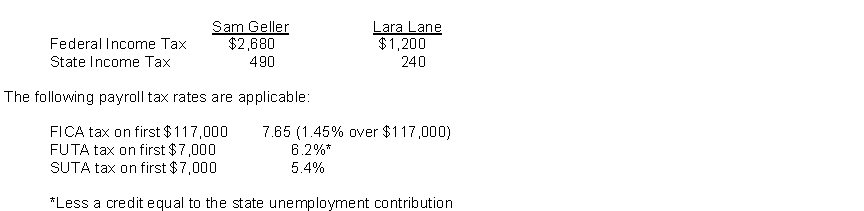

Sam Geller had earned (accumulated) salary of $110,000 through November 30. His December salary amounted to $9,800. Lara Lane began employment on December 1 and will be paid her first month's salary of $7,000 on December 31. Income tax withholding for December for each employee is as follows:  Instructions

Instructions

Record the payroll for the two employees at December 31 and record the employer's share of payroll tax expense for the December 31 payroll. Round all calculations to the nearest dollar.

Definitions:

Nonprofit Organizations

Entities that operate without the primary goal of making a profit, focusing instead on social, charitable, educational, or recreational objectives.

Telling Time

The act of determining the current time through various means, including clocks, watches, and sundials.

Building Clocks

Large clock displays that are usually mounted on public buildings and are considered symbols of community or institutional pride.

Distinct Field

A specific area of study, work, or interest that is clearly differentiated from others due to unique characteristics.

Q1: Analyze the transactions of a business organized

Q4: The following transactions represent part of the

Q8: The future value of an annuity factor

Q72: Tendon sheaths _.<br>A) are extensions of periosteum<br>B)

Q73: Describe the anatomical parts of the muscle

Q79: Easton Company began business on October 1.

Q84: Which of the following would not be

Q176: A trial balance is a listing of<br>A)

Q199: In recognizing a decline in the fair

Q199: Financial information that is capable of making