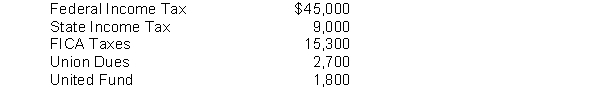

Warren Company's payroll for the week ending January 15 amounted to $200,000 for salaries and wages. None of the employees has reached the earnings limits specified for federal or state employer payroll taxes. The following deductions were withheld from employees' salaries and wages:  Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Federal unemployment tax (FUTA) rate is 6.2% less a credit equal to the rate paid for state unemployment taxes. The state unemployment tax (SUTA) rate is 5.4%.

Instructions

Prepare the journal entries to record the weekly payroll ending January 15 and also the employer's payroll tax expense on the payroll.

Definitions:

Prescriptive

Relating to the imposition or application of rules and recommendations for behavior or action.

Brainstorming Method

A creative group problem-solving technique that involves generating a large number of ideas in order to find a solution to a particular issue.

Ranking

The act of arranging or grading individuals, items, or concepts according to their achieved level, performance, or quality.

Delphi Technique

A structured communication method that relies on a panel of experts answering questionnaires in two or more rounds to converge on a consensus solution or decision.

Q1: Which joints are correctly matched?<br>A) interphalangeal; plane<br>B)

Q4: Corporations purchase investments in debt or equity

Q35: A good internal control feature is to

Q52: Proving the postings of a single-column purchases

Q61: Crespo Company purchased 42,000 shares of common

Q66: A company uses a sales journal, cash

Q85: On December 1, the accounts receivable control

Q97: The balance in the Unrealized Loss-Equity account

Q129: An account is an important accounting record

Q234: The common characteristic possessed by all assets