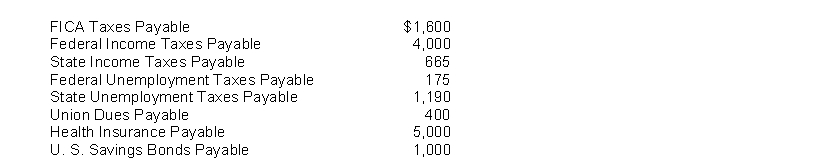

The following payroll liability accounts are included in the ledger of Clementine Company on January 1, 2018:  In January, the following transactions occurred:

In January, the following transactions occurred:

Jan. 9 Sent a check for $5,000 to Blue Cross and Blue Shield.

11 Deposited a check for $5,600 in Federal Reserve Bank for FICA taxes and federal income taxes withheld.

14 Sent a check for $400 to the union treasurer for union dues.

18 Paid state income taxes withheld from employees.

21 Paid state and federal unemployment taxes.

22 Purchased U. S. Savings Bonds for employees by writing a check for $1,000.

Instructions

Journalize the January transactions

Definitions:

Mechanistic Behavior

Behavior explained through physical or mechanical processes, often neglecting emotional or psychological factors.

Mask

A facade or front that an individual presents to the world, often concealing their true thoughts or feelings.

Social Networking Sites

Online platforms where individuals can create profiles, interact with friends and strangers, share information, and participate in various forms of social activities.

Self-image

An individual's perception of their attributes, abilities, and overall value, which forms a critical aspect of their identity.

Q6: A subsidiary ledger is<br>A) used in place

Q17: Presented below are three different aircraft lease

Q35: Larson Company has twenty employees who each

Q39: Interest is the difference between the amount

Q40: Postings are generally made more frequently to

Q53: PWAT Inc. had these transactions pertaining to

Q53: Net income results when<br>A) Assets > Liabilities.<br>B)

Q133: Mazzeo Company acquires 80 Dodd's 10%, 5

Q164: Martin Corporation purchased land in 2010 for

Q226: Accounting communicates financial information about a business