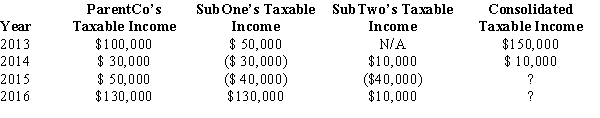

ParentCo and SubOne have filed consolidated returns since 2012. SubTwo was formed in 2014 through an asset spin-off from ParentCo. SubTwo has joined in the filing of consolidated returns since then. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

If ParentCo does not elect to forgo the carryback of the 2015 net operating loss, how much of the 2015 consolidated net operating loss is carried back to offset prior years' income?

Definitions:

Biological Children

Children who are genetically related to their parents, as opposed to children who are adopted or stepchildren.

Conflicting Goals

The situation where different objectives or desired outcomes are at odds with each other, leading to disagreement or compromise.

Family Lifecourse

A perspective focusing on the stages and transitions individuals and families go through over time, such as marriage, parenthood, retirement.

Lesbian Co-Parent Family

A family structure where children are raised by two female partners who share parental responsibilities and roles.

Q15: Choice of tax year-ends by affiliates<br>A)Advantage of

Q20: An example of the "aggregate concept" underlying

Q24: The receipt of nonqualified preferred stock in

Q24: If a parent corporation makes a §

Q26: Manx Corporation transfers 40% of its stock

Q59: Tax compliance deadlines and recordkeeping<br>A)Advantage of consolidating<br>B)Disadvantage

Q71: PaulCo, DavidCo, and Sean form a partnership

Q119: Which of the following is not generally

Q125: ParentCo purchased all of the stock of

Q130: The Nannerl consolidated group reported the following