Returns on Investment

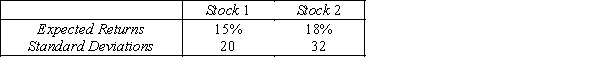

An analysis of the stock market produces the following information about the returns of two stocks.  Assume that the returns are positively correlated with correlation coefficient of 0.80.

Assume that the returns are positively correlated with correlation coefficient of 0.80.

-{Returns on Investment Narrative} Find the mean of the return on a portfolio consisting of an equal investment in each of the two stocks.

Definitions:

Total Surplus

The sum of consumer surplus and producer surplus; a measure of the total benefit to society from a market transaction.

Consumer Surplus

The differential between consumers’ readiness to pay a certain amount for a service or good and the payment completed.

Equilibrium

The condition in a market where the quantity demanded equals the quantity supplied, leading to no inherent force for price change.

Property Rights

Legal rights to possess, use, and dispose of assets, including real estate, intellectual property, or physical goods, crucial for the functioning of markets and economies.

Q29: In the Poisson distribution, the _ is

Q67: Nonresponse error occurs when someone was not

Q72: Two events A and B are said

Q90: The covariance between two investments of a

Q107: The amount of bleach a machine pours

Q107: Suppose P(A) = 0.30. The probability of

Q112: {Graduate Internships Narrative} Find the expected

Q113: If the probability of success p remains

Q186: {Elizabeth's Portfolio Narrative} Compute the standard deviation

Q204: The portfolio expected return of two investments:<br>A)will