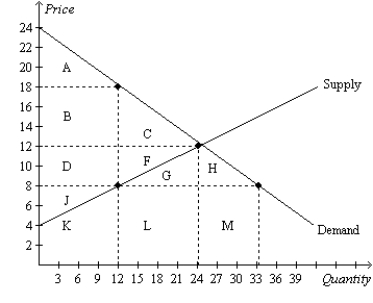

Figure 8-8

Suppose the government imposes a $10 per unit tax on a good.

-Refer to Figure 8-8.The tax causes producer surplus to decrease by the area

Definitions:

Large Intestine

The last part of the digestive system, responsible for water absorption and the formation of feces.

Heavy Frequent

A term that might refer to the regular occurrence of something in large amounts, though in the context of health, it is not a recognized key term. NO.

Moderate Frequent

Describing actions or occurrences that happen at a moderate pace or degree and on a regular basis.

Alcohol Dehydrogenase

An enzyme that helps break down alcohol in the stomach. Women have significantly less of this enzyme than men.

Q15: Refer to Figure 9-6.Before the tariff is

Q25: Other things equal,the deadweight loss of a

Q32: Refer to Figure 8-11.Suppose Q<sub>1</sub> = 4;Q<sub>2</sub>

Q104: When a tax is levied on the

Q150: A tax placed on buyers of airline

Q290: Which of the following tools and concepts

Q353: When a tax is imposed on sellers,consumer

Q378: Refer to Figure 8-11.The length of the

Q396: Refer to Figure 9-14.A result of this

Q446: Donald produces nails at a cost of