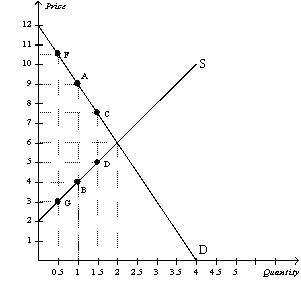

Figure 8-17

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-17.If the government changed the per-unit tax from $5.00 to $2.50,then the price paid by buyers would be $7.50,the price received by sellers would be $5,and the quantity sold in the market would be 1.5 units.Compared to the original tax rate,this lower tax rate would

Definitions:

Exchange Rate

The value of one currency for the purpose of conversion to another, indicating how much of one currency can be exchanged for another.

U.S. Goods

Products and commodities that are manufactured or produced within the United States.

Summer Vacations

A period during the summer months where individuals take a break from work or school activities, often involving travel or leisure activities.

Supply Curve

A graphical representation showing the relationship between the price of a good or service and the quantity of that good or service that suppliers are willing and able to provide in the market.

Q37: Refer to Figure 7-23.Which of the following

Q93: Refer to Figure 9-9.The change in total

Q244: Refer to Figure 8-7.Before the tax is

Q312: Refer to Figure 9-16.Government revenue raised by

Q323: When a nation first begins to trade

Q326: Refer to Figure 8-9.The amount of tax

Q368: The demand for bread is less elastic

Q409: Refer to Figure 9-2.If this country chooses

Q416: If the world price of textiles is

Q446: Refer to Figure 8-6.When the tax is