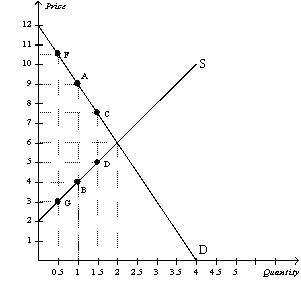

Figure 8-17

The vertical distance between points A and B represents the original tax.

-Refer to Figure 8-17.If the government changed the per-unit tax from $5.00 to $7.50,then the price paid by buyers would be $10.50,the price received by sellers would be $3,and the quantity sold in the market would be 0.5 units.Compared to the original tax rate,this higher tax rate would

Definitions:

Entrepreneurial Style

The unique manner in which an entrepreneur approaches challenges, opportunities, and the management of their business venture.

Investment Banker

A professional who works in a financial institution, dealing with the creation of capital for other companies, governments, and other entities.

Fortune 500

A yearly ranking of the 500 largest US corporations by total revenue for their respective fiscal years, published by Fortune magazine.

Chief Marketing Officer

A senior executive responsible for leading a company's marketing efforts, including strategy, brand management, and market research.

Q11: A quota is<br>A) a tax placed on

Q198: Refer to Figure 8-12.Which of the following

Q212: Which of the following is not an

Q277: Refer to Figure 9-5.With trade,consumer surplus is<br>A)

Q296: About what percent of total world trade

Q297: Refer to Figure 8-7.As a result of

Q324: If producing a soccer ball costs Jake

Q353: When a tax is imposed on sellers,consumer

Q396: Refer to Figure 9-14.A result of this

Q438: To measure the gains and losses from