Use the Following Information for Questions 98 Through 100 Included in Accounts Receivable Is $1,200,000 Due from a Customer

Use the following information for questions 98 through 100.

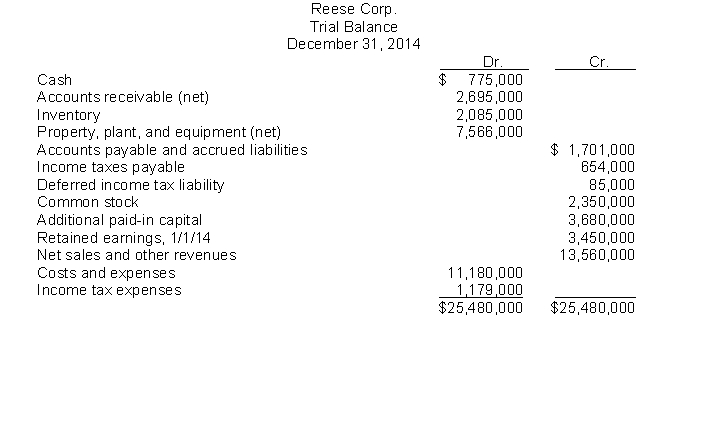

The following trial balance of Reese Corp. at December 31, 2014 has been properly adjusted except for the income tax expense adjustment.  Other financial data for the year ended December 31, 2014:

Other financial data for the year ended December 31, 2014:

Included in accounts receivable is $1,200,000 due from a customer and payable in quarterly installments of $150,000. The last payment is due December 29, 2016.

The balance in the Deferred Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $20,000 is classified as a current liability.

During the year, estimated tax payments of $525,000 were charged to income tax expense. The current and future tax rate on all types of income is 30%.

In Reese's December 31, 2014 balance sheet,

-The current assets total is

Definitions:

Unexpected Assignment

A task or project given with little to no prior notice, requiring immediate attention and action.

Stress

The psychological and physical response to perceived challenges or threats in one's environment.

Reflect

To think about something in a purposeful way with the intention of creating new meaning.

Peak Performer

A person who is successful and desires to pursue a lifetime of learning.

Q20: With a perpetual inventory system, a company

Q24: A disadvantage of the gross profit method

Q30: Which of these is generally an example

Q33: The cost of goods sold for the

Q41: Trade-offs between the characteristics that make information

Q54: Norris Corporation purchased factory equipment that was

Q66: The correct order to present current assets

Q74: Which of the following is not considered

Q76: Moore Company estimates its annual warranty

Q80: Users of financial statements are assumed to