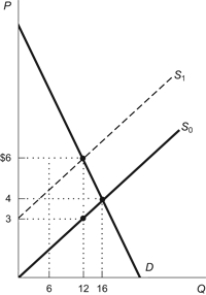

Use the following to answer questions: Figure: Tax on Sellers

-(Figure: Tax on Sellers) Refer to the figure. Suppose the imposition of a per-unit tax on sellers shifts the supply curve from S0 to S1. The equilibrium quantity sold under the tax is:

Definitions:

CPI

This index tracks the overall price changes of a mix of consumer products and services like healthcare, transportation, and food by calculating their weighted average price.

Inflation Rate

A measure reflecting how much prices of goods and services have increased in a given period, reducing the purchasing power of money.

Market Basket

A set combination of goods and services used as a consistent measure to track the cost of living and inflation through price changes over time.

Basket of Goods

A selected group of products whose prices are tracked over time for the purpose of measuring inflation.

Q38: Figure: Minimum Wage for Country A <img

Q70: If price controls are imposed, gains from

Q72: Futures contracts are standardized agreements to buy

Q101: A tax targeted to reduce consumption of

Q170: Consider a market that is described by

Q179: When supply and demand are equally elastic,<br>A)

Q215: If a 4 percent increase in the

Q217: The United States attempted to centrally plan

Q226: If the CEO of a company needs

Q321: Which is the MOST correct statement about