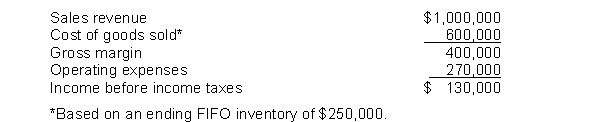

Eckert Company reported the following summarized annual data at the end of 2014:  The income tax rate is 30%. The controller of the company is considering a switch from FIFO to average-cost. He has determined that on an average-cost basis, the ending inventory would have been $220,000.

The income tax rate is 30%. The controller of the company is considering a switch from FIFO to average-cost. He has determined that on an average-cost basis, the ending inventory would have been $220,000.

Instructions

(a) Restate the summary information on an average-cost basis.

(b) What effect, if any, would the proposed change have on Eckert's income tax expense, net income, and cash flows?

(c) If you were an owner of this business, what would your reaction be to this proposed change?

Definitions:

Fallacy

An error in reasoning that renders an argument invalid or leads to an incorrect conclusion.

Argument's Premises

The foundational statements or propositions upon which an argument is based and from which conclusions are drawn.

Gambler's Fallacy

The erroneous belief that if something occurs more frequently than normal during a given period, it will happen less frequently in the future, or vice versa.

Legal Standards

Accepted principles that guide behavior and proceedings within legal cases.

Q13: On October 1, Belton Bicycle Store had

Q38: Paxson Supply Company uses a periodic inventory

Q76: At May 1, 2014, Deitrich Company had

Q98: The income statement for the year 2014

Q128: Cash registers are an important internal control

Q139: Sales Returns and Allowances and Sales Discounts

Q226: Shandy Shutters has the following inventory information.

Q226: The revenue recognition principle applies to merchandisers

Q237: A new average cost is computed each

Q255: Your roommate is uncertain about the advantages