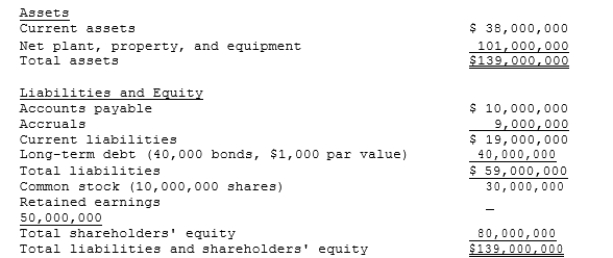

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable

The stock is currently selling for $15.25 per share, and its noncallable

$1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-What is the best estimate of the firm's WACC?

Definitions:

Cultural Influence

The impact that a society's values, beliefs, and practices have on the behavior and attitudes of its members.

Mirror Neuron

A neuron that fires both when an individual acts and when the individual observes the same action performed by another, thought to be involved in learning through imitation.

Specific Action

A particular or distinct deed or movement carried out with a purpose in mind.

Amygdala

A region of the brain involved in processing emotions such as fear, anger, and pleasure.

Q5: Consider the balance sheet of Wilkes Industries

Q8: The assumption that assumes a company will

Q15: A corporation is usually managed by<br>A) stockholders.<br>B)

Q23: Gordan Company sold old equipment for $40,000.

Q26: GCC Corporation is planning to issue options

Q53: The primary reason the annual report is

Q53: "Capital" is sometimes defined as funds supplied

Q57: What is the firm's ROE?<br>A) 8.54%<br>B) 8.99%<br>C)

Q81: The cost of debt, rd, is normally

Q91: The cost of preferred stock to a