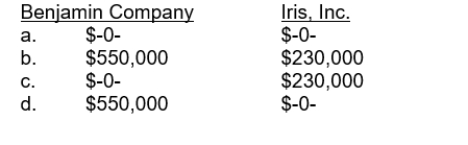

Benjamin Company uses IFRS, while Iris, Inc. uses U.S. GAAP, for their externalfinancial reporting. On January 16, 2015, both companies settled lawsuits relating toindustrial accidents that occurred in 2013. Benjamin Company paid $550,000 and Iris, Inc.paid $230,000. Assuming that no accrual had been previously made, what amount of lossshould be reported on the income statement for the year ended December 31, 2014 foreach company?

Definitions:

Good Contract

An agreement that is valid under the law and contains all the essential elements making it enforceable and binding.

Definition

A statement that explains the meaning of a term or phrase, clarifying its notion and context within a particular field.

Technical Requirements

Detailed specifications to which a product, service, or system must adhere.

Negotiable Instrument

A document in writing that promises to pay a specified sum of money, either upon request or at an agreed-upon date, with the document specifying the individual responsible for payment.

Q17: Haystack, Inc. manufactures machinery used in the

Q19: Companies HD and LD have identical tax

Q50: Pisa, Inc. leased equipment from Tower Company

Q54: In January 2015, Post, Inc. estimated that

Q62: What is AJC's current total market value

Q62: When preparing a statement of cash flows

Q84: In determining net cash flow from operating

Q88: Employers are at risk with defined-benefit plans

Q90: Haystack, Inc. manufactures machinery used in the

Q111: Minimum lease payments may include a<br>A) penalty