Use the following information for questions 57 through 59.

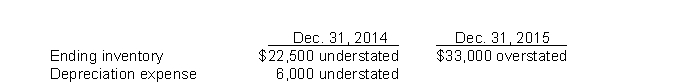

Langley Company's December 31 year-end financial statements contained the following errors:  An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

An insurance premium of $54,000 was prepaid in 2014 covering the years 2014, 2015, and 2016. The prepayment was recorded with a debit to insurance expense. In addition, on December 31, 2015, fully depreciated machinery was sold for $28,500 cash, but the sale was not recorded until 2016. There were no other errors during 2015 or 2016 and no corrections have been made for any of the errors. Ignore income tax considerations.

-What is the total net effect of the errors on the amount of Langley's working capital at December 31, 2015?

Definitions:

Mate Selection

The process by which individuals choose their partners, influenced by a variety of biological, psychological, and social factors.

Professional Status

The standing, respect, or prestige a person holds in a professional context, often based on career achievement and recognition.

Dispositional Attributions

The tendency to attribute someone's behavior to their personality or character traits rather than to situational factors.

Independent

The state of being free from outside control or influence, capable of thinking or acting for oneself in a self-reliant manner.

Q3: The actual return on plan assets in

Q3: Uncertain tax positions<br>I.Are positions for which the

Q23: Which of the following statements is CORRECT?<br>A)

Q51: Challenges to convergence of IFRS with U.S.

Q53: When companies make changes that result in

Q61: As a member of UA Corporation's financial

Q81: Which of the following best characterizes the

Q93: The principal disadvantage of using the percentage-of-completion

Q98: A deferred tax asset represents the increase

Q107: A deferred tax liability is classified on