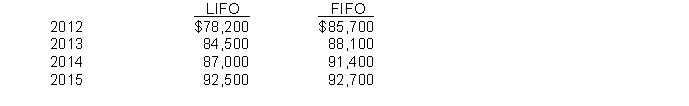

In 2015, Fischer Corporation changed its method of inventory pricing from LIFO to FIFO. Net income computed on a LIFO as compared to a FIFO basis for the four years involved is: (Ignore income taxes.)

Instructions

(a) Indicate the net income that would be shown on comparative financial statements issued at 12/31/15 for each of the four years, assuming that the company changed to the FIFO method in 2015.

(b) Assume that the company had switched from the average cost method to the FIFO method with net income on an average cost basis for the four years as follows: 2012, $80,400; 2013, $86,120; 2014, $90,300; and 2015, $93,600. Indicate the net income that would be shown on comparative financial statements issued at 12/31/15 for each of the four years under these conditions.

(c) Assuming that the company switched from the FIFO to the LIFO method, what would be the net income reported on comparative financial statements issued at 12/31/15 for 2012, 2013, and 2014?

Definitions:

Double Helix

The structure formed by double-stranded molecules of nucleic acids such as DNA, characterized by its spiraling ladder shape.

Carrier

A person who carries and transmits characteristics but does not exhibit them.

Transmits Characteristics

The process by which genetic features and traits are passed down from parents to their offspring.

Double Helix

The structure of DNA, characterized by two strands coiled around each other, forming a shape similar to a twisted ladder, responsible for genetic inheritance.

Q12: A company changes from the straight-line method

Q20: An example of a correction of an

Q44: Assuming that income taxes payable for 2015

Q47: Leasing equipment reduces the risk of obsolescence

Q53: Jarvis, Inc. reported net income of

Q85: Equipment which cost $213,000 and had accumulated

Q90: Selected Information about the pension plan of

Q97: Hayes Construction Corporation contracted to construct a

Q114: What is the amount of the lessee's

Q116: The relationship between the amount funded and