Use the following information for questions 61 through 63.

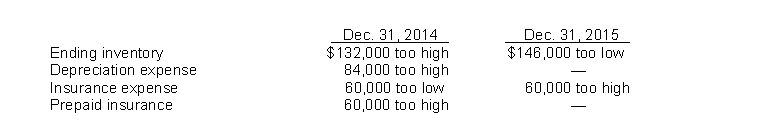

Bishop Co. began operations on January 1, 2014. Financial statements for 2014 and 2015 con- tained the following errors:  In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on Bishop's 2015 net income is

Definitions:

Gelatin

A translucent, colorless, flavorless food ingredient derived from collagen obtained from various animal body parts, used in food as a gelling agent.

Intracellular Antioxidant

A substance within cells that reduces oxidative damage by neutralizing free radicals, thereby protecting cellular integrity.

Cell Structures

The components and organelles within a cell that contribute to its function, including the nucleus, mitochondria, and cell membrane.

Vitamin E

Vitamin E is a group of eight fat-soluble compounds that play critical roles in antioxidant activity, skin health, and cellular function in the human body.

Q5: IFRS requires that any indirect effect of

Q13: Direct-financing lease (essay).Explain the procedures used to

Q38: Lanier Company began operations on January 1,

Q63: On January 1, 2012, Knapp Corporation acquired

Q66: Which of the following statements is CORRECT?<br>A)

Q94: What is the pension expense that Cooper

Q95: Selected information from Dinkel Company's 2015

Q100: Dunn, Inc. uses the accrual method of

Q120: Foxx Corp.'s comparative balance sheet at December

Q138: Under the completion-of-production basis, companies recognize revenue