Use the following information for questions 61 through 63.

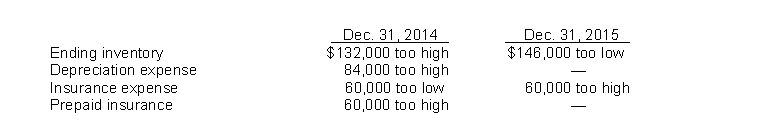

Bishop Co. began operations on January 1, 2014. Financial statements for 2014 and 2015 con- tained the following errors:  In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

In addition, on December 31, 2015 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2016. No corrections have been made for any of the errors. Ignore income tax considerations.

-The total effect of the errors on the amount of Bishop's working capital at December 31, 2015 is understated by

Definitions:

Culture Shock

A sense of confusion or uncertainty that sometimes occurs when a person is exposed to a new, unfamiliar culture, way of life, or set of attitudes.

American Tourism Syndrome

The phenomenon where tourists from the United States or its cultural influences expect or demand familiar comforts and services abroad, often at the expense of local customs and economies.

Cultural Adaptation

The process by which individuals or groups adjust and modify their cultural practices and beliefs to align with those of a new or different culture.

Cultural Relativism

The principle that an individual's beliefs and behaviors should be understood by others in terms of that individual's own culture, rather than being judged against the criteria of another culture.

Q8: Both a guaranteed and an unguaranteed residual

Q24: IFRS requires companies to prepare interim reports

Q27: In considering interim financial reporting, how does

Q29: The distinction between a direct-financing lease and

Q38: Which of the following statements is CORRECT?<br>A)

Q44: Aggarwal Enterprises is considering a new project

Q54: In January 2015, Post, Inc. estimated that

Q66: For counterbalancing errors, restatement of comparative financial

Q87: The deferred tax liability to be recognized

Q139: The amortization of bond premium on long-term