Use the following information for questions 44 and 45.

Dream Home Inc., a real estate developing company, was accounting for its long-term contracts using the completed contract method prior to 2015. In 2015, it changed to the percentage-of-completion method.

The company decided to use the same for income tax purposes. The tax rate enacted is 40%.

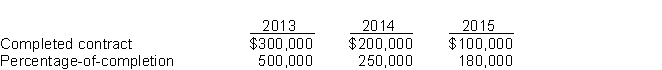

Income before taxes under both the methods for the past three years appears below.

-Which of the following will be included in the journal entry made by Dream Home to record the income effect?

Definitions:

Orbits Around

The curved path of an object around a point in space, typically describing the movement of celestial bodies.

Volcanically Active

Refers to a state where a volcano is currently erupting or shows signs of potentially erupting in the near future.

Sulfur-Rich Lava

Lava that contains high levels of sulfur, typically associated with highly explosive volcanic eruptions and producing distinctive yellow deposits.

Galilean Moons

The four largest moons of Jupiter—Io, Europa, Ganymede, and Callisto—discovered by Galileo Galilei in 1610.

Q16: Mays Company has a machine with a

Q24: What are the criteria that must be

Q46: Anderson Systems is considering a project that

Q46: Which of the following lease-related revenue and

Q52: The accountant for Marlin Corporation has developed

Q64: Assume a project has normal cash flows.

Q69: Pretax financial income is the amount used

Q74: The full disclosure principle, as adopted by

Q76: The primary purpose of the statement of

Q85: The total lease-related income recognized by the