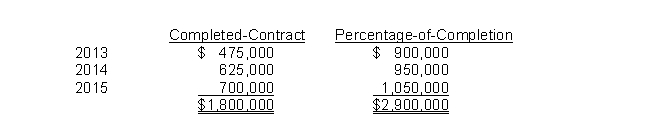

During 2015, a construction company changed from the completed-contract method to the percentage-of-completion method for accounting purposes but not for tax purposes. Gross profit figures under both methods for the past three years appear below:  Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

Definitions:

Q8: At December 31, 2015, the current ratio

Q22: In a defined-contribution plan, a formula is

Q32: Deductible amounts cause taxable income to be

Q42: Errors in financial statements result from mathematical

Q46: When a company decides to switch from

Q67: On January 2, 2014, Gold Star Leasing

Q74: IFRS requires lesses to.use their incremental rate,

Q81: A temporary difference arises when a revenue

Q94: Lease A does not contain a bargain

Q115: Roman Company leased equipment from Koenig Company