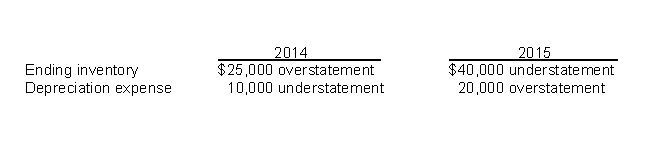

Use the following information for questions 55 and 56.

Armstrong Inc. is a calendar-year corporation. Its financial statements for the years ended 12/31/14 and 12/31/15 contained the following errors:

-Assume that no correcting entries were made at 12/31/14, or 12/31/15. Ignoring income taxes, by how much will retained earnings at 12/31/15 be overstated or understated?

Definitions:

Lead Roles

Principal or main characters in a performance, such as a film, play, or television show, around whom the plot centers.

2014-2015 Season

A specific time period used to reference events, sports seasons, or academic years, in this context likely referring to events or activities happening between 2014 and 2015.

2011-2012 Season

A specific period used to denote a cycle of events, shows, sports, or academic years, often starting in 2011 and ending in 2012.

Sociologists

Social scientists who study human societies, patterns of social relationships, social interaction, and culture.

Q10: Income taxes payable is<br>A) $0.<br>B) $150,000.<br>C) $300,000.<br>D)

Q19: Zook Incorporated, had net income for

Q38: A benefit of leasing to the lessor

Q48: In 2014, Krause Company accrued, for financial

Q61: Companies recognize the accumulated benefit obligation in

Q65: Major reasons why a company may become

Q105: The Construction in Process account includes only

Q109: Cashman Company reported net income of $265,000

Q110: A pension liability is reported when<br>A) the

Q145: Under the cost-recovery method, a company recognizes